A common theme running through customer complaints about Red Rock dealerships is that the customers discovered thousands of dollars in extended warranties added to their contracts without the dealership telling them about it, and they spotted these extra charges only after their signatures had been affixed to their contracts electronically. Customers repeatedly say they did not want these warranties and never agreed to them, only to find they had been added to their contracts anyway when they finally saw their paperwork. Once saddled with them, the customers had to go through the ordeal of trying to cancel them quickly, because the warranties are only fully refundable within 60 days after purchase.

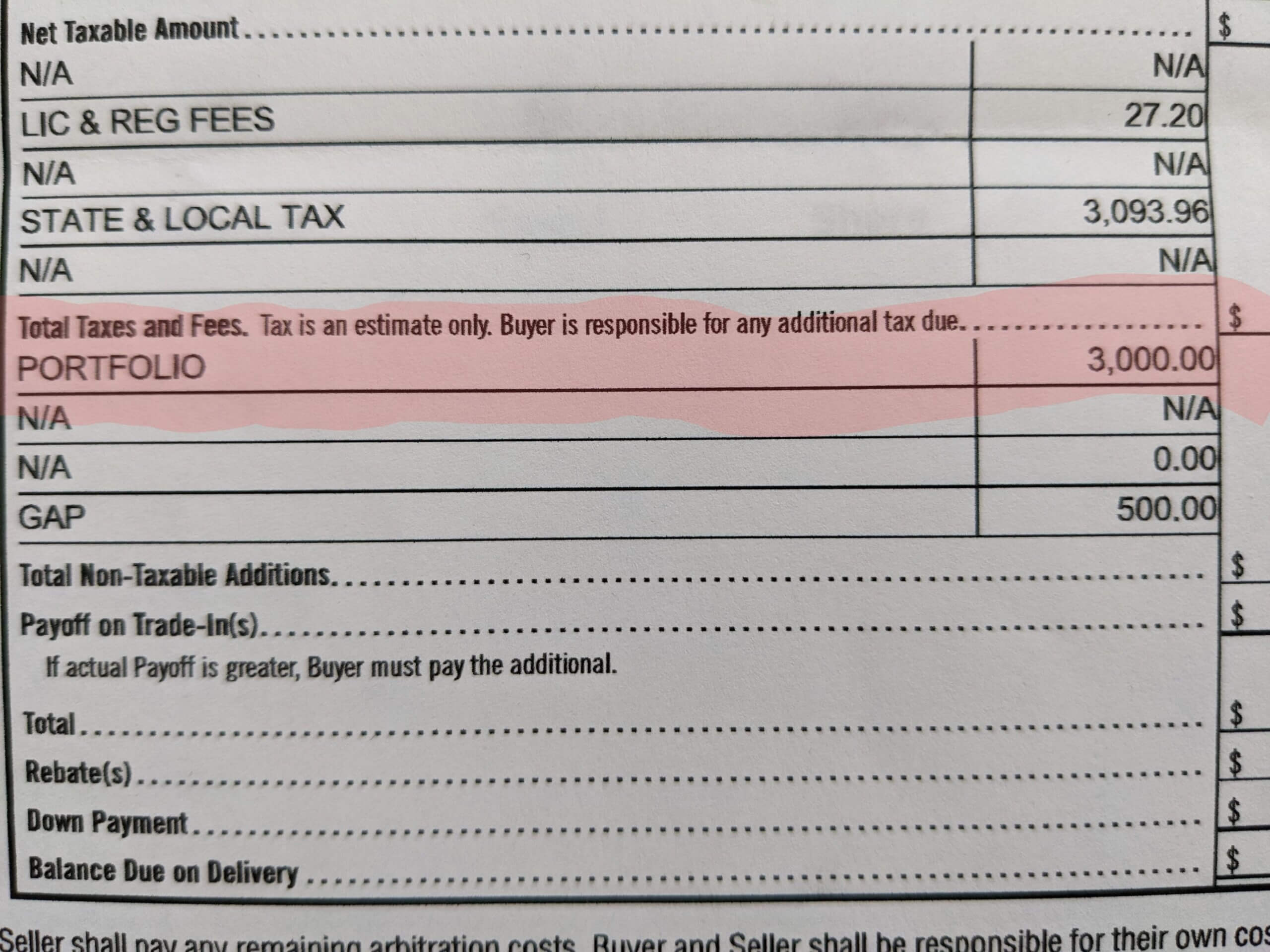

Red Rock even adds these extended warranties to purchases of brand new cars with manufacturer’s warranties, as happened to the Mondragons, who bought a new 2022 Nissan Frontier truck from Red Rock Nissan, fell victim to the iPad trick, weren’t shown their contract while at the dealership, and when they got home saw they’d been charged $3,000 extra for an extended warranty they didn’t want and never agreed to.

Red Rock adds these warranties to contracts by using only the warranties’ brand names, like “VSC Endurance” or “Portfolio,” without any further description telling customers what they are. This makes it hard for customers to understand exactly what has been added to their purchase even if they do get to see their contracts.

The brand of warranty Red Rock prefers to sell, particularly on purchases of new and used vehicles with under 75,000 miles on them, is the “Portfolio” brand.

Red Rock GMC added an unauthorized $4,495 Portfolio extended warranty to the contract of “Daniel Macias,” (not his real name) who fell victim to the IPad trick last summer and never saw his contract. And the massive $10,000 extended warranty contract on which a Red Rock Hyundai employee forged Jesus Acevedo’s name last January in an attempt to slip the charge into his deal without his knowing was also a Portfolio brand contract.

Over and over, people report having been tricked into paying for these expensive extended Portfolio warranties at Red Rock dealerships. So why do Red Rock employees take such risks to get these expensive Portfolio warranties onto people’s contracts, warranties customers very often don’t even want?

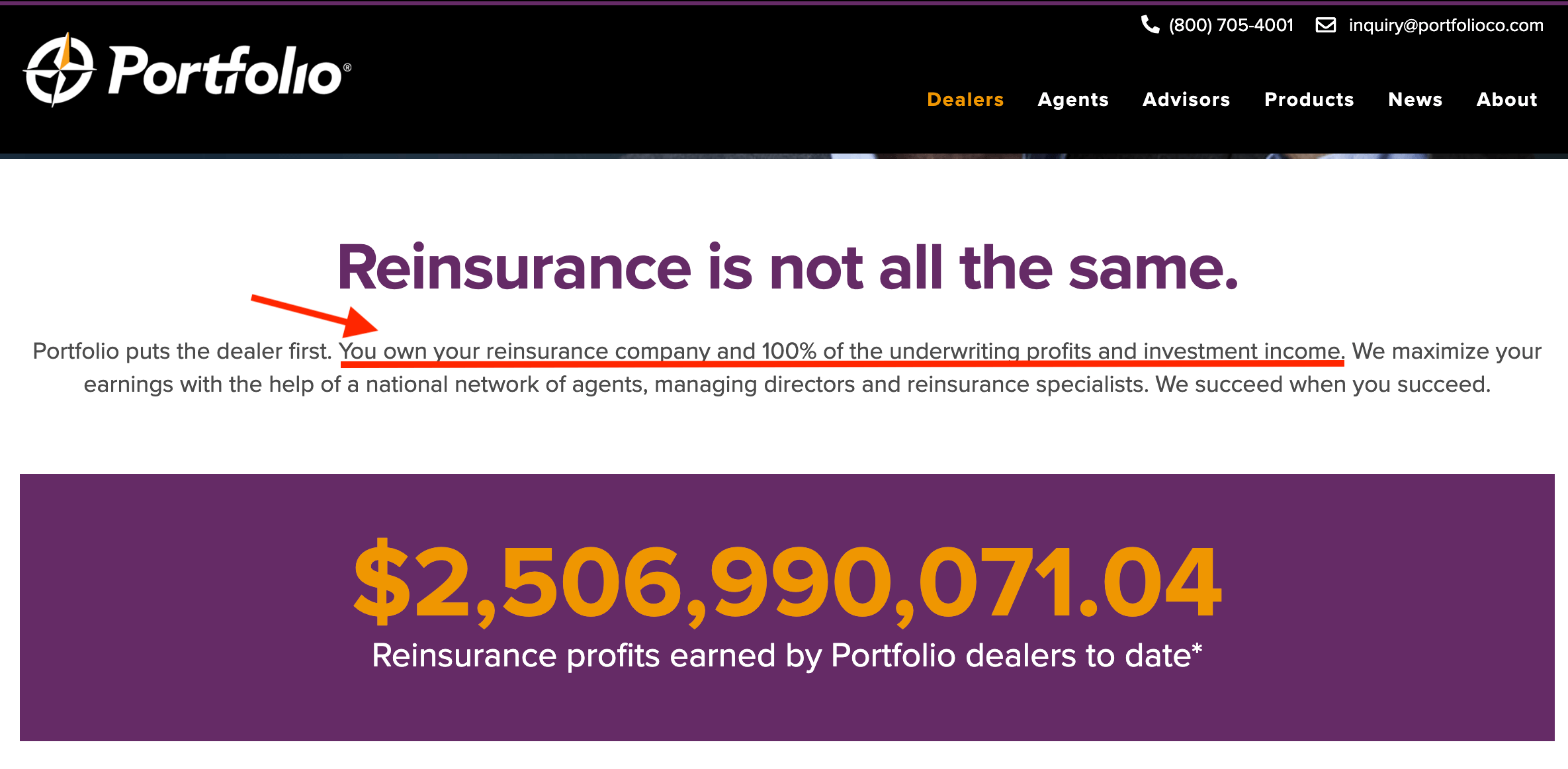

Because Red Rock owns the extended warranty company.

Red Rock is a reinsurer of the parent company, the Portfolio Company, meaning that Red Rock gets to keep 100% of the premiums they charge customers for Portfolio extended warranties, and then pay for covered repairs out of the funds they collect. This effectively turns Red Rock into a little insurance company of its own, and in so doing this helps the bigger Portfolio Company reduce the risk it carries. Reinsurers like Red Rock own 100% of their own reinsurance companies, and get to keep 100% of the money they make off customers from selling things that are not the car, like extended warranties and other Portfolio brand add-on products, including service contracts, dent and ding insurance, tire and wheel protection, key fob insurance, theft deterrence, etc. The owner of a dealership can also choose to invest all the money they reap, too, and can keep the investment income from it, too. It says so on Portfolio’s website:

Sales of Portfolio products make dealerships LOTS of money.

Reinsurance generates a tremendous amount of money for those fortunate enough to be reinsurers. In fact, one investment article encourages reinsurers to stash the money they make in offshore accounts in the Turks and Caicos Islands, to get tax advantages and “a lighter touch” from regulators.

Portfolio’s website pitching their reinsurance program to dealers boasts that:

- “Your reinsurance company is your personal wealth asset,”

- “Dealers use reinsurance companies to build wealth — often far more than they dreamed possible.”

- “Builds personal wealth for owners.”

Another benefit of selling Portfolio warranties and maintenance contracts is that it helps dealerships rope customers into using their service and repair shops exclusively as long as customers are within 40 miles of their store, even if customers don’t like the quality of the service they get there. This is called a “tieback,” and it brings even more income into the dealerships. A 2019 article about such proprietary service contracts in Auto News says:

“We see the importance of getting people back into our service department,” [General Manager] Hanson says. “If you sell a maintenance package with a tieback, we’re married.”

Not only are these warranties, maintenance packages and other extras fantastic wealth builders for Red Rock’s owners, but they’ve been key to funding Red Rock’s rapid expansion in Grand Junction.

A former Red Rock finance employee told AnneLandmanBlog:

That’s how they ended up buying all this stuff out here, because they’ve been reinsured with Portfolio for so long, and have been selling Portfolio warranties for so long…it’s insurance, all that money has basically been piled up… I’ll put it this way: I used to sell a different warranty when I got here because I thought it was better. I got threatened to the point where I was going to get fired, and the reason? He [platform manager Brantley Reade] looked at me and said, “You know why we sell Portfolio here?” and I’m like, “Because we’re reinsured with them?” and he said, “That’s not the only reason. The reason why is because that’s what pays for all the expansion, that’s what pays for all the new dealerships, that’s what pays all the bills.”

Red Rock bought their first dealership in Grand Junction 2016. Now, just 7 years later, they’ve bought five of them.

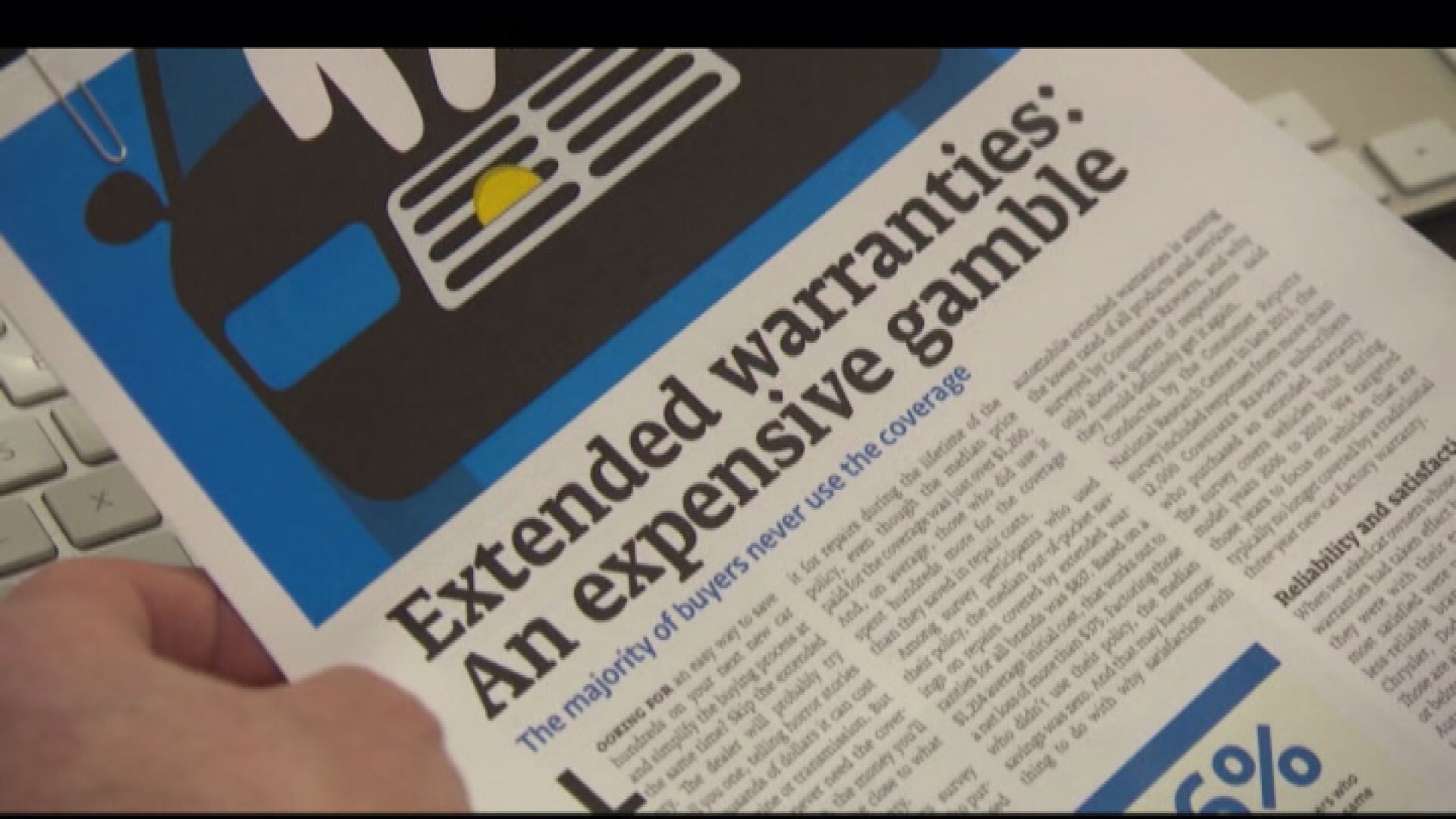

But while these extended warranties and other products are fantastic at lining the pockets of Red Rock’s owners and helping them gobble up more local dealerships, they may not be so fantastic for customers.

There are many drawbacks to buying proprietary extended warranties like “Portfolio:”

- They’re expensive. Often repairs cost less than the amount of the warranty.

- The dealership adds the cost of the warranty to the amount you finance, so you end up paying interest on the warranty, too, which makes buying the vehicle even more expensive.

- A third party warranty like Portfolio isn’t necessary if you’re buying a car new enough that it has, or still has, a manufacturer’s warranty.

Third-party warranty companies like Portfolio exist to make money, so their contracts are written to the advantage of the sellers, not the buyers.

Third-party warranty companies like Portfolio exist to make money, so their contracts are written to the advantage of the sellers, not the buyers.- Such warranties are full of loopholes, exclusions and limitations that favor the dealer.

- They restrict where you can have your car serviced through “tiebacks.”

- They have deductibles that can cost hundreds of dollars in addition to what you’ve already laid out for the warranty.

- You might be better off putting all the money the warranty would cost into a high-interest savings account and letting it grow until you need a repair.

- There may be a waiting period after you buy an extended warranty since the warranty company doesn’t want to have to cover pre-existing problems that could occur shortly after someone buys a used car.

- Consumer Reports found 55% of people who bought extended warranties never used them, and even among those who did, they spent far more for the coverage than they saved in repairs.

- If you buy a car with a strong reliability record, you are less likely to need an extended warranty.

- If you’re buying a relatively new used car that is still under the manufacturer’s warranty, you may be able to buy an extended warranty from the vehicle’s manufacturer that you will be able to use anywhere.

- You might want to keep your option to buy an extended warranty of your own choosing from a company that has established a good reputation, instead of letting the dealership pick a warranty company for you that benefits them financially and might not be as good.

In any case, be careful out there, and be well-informed before you agree to any deal that could potentially sink you and your family into deep financial trouble.

#FraudRock

Hi, I bought a vehicle(2014 dodge ram) from Red Rock Nissan in December of 2020, and got the extended warranty, and now my vehicle has been sitting on their lot since 8/7/24, and today is 9/17/24. The part needed is discontinued and they are refusing to fix/make the situation right. Their proposed solution was to take it to Dodge(who is also unable to locate a discontinued part/fix). It is still covered under warranty. I spoke to Barry(service director) who stated, he has never had this situation happen before, and is willing to make the situation right if needed, but now are passing the buck. They stated they have been calling into the warranty company which they own, to find a discontinued part. What are my options? I also have a loaner vehicle which they are asking to be returned, and pick up my non working/ non drivable vehicle.

Hi Leroy, you can make a claim against Red Rock Nissan’s surety bond. The state requires the dealership to be insured for claims up to $50,000. The bond is to protect customers by assuring that the dealership adheres to all laws, and that they operate ethically and deal in good faith. If you have proof that they haven’t done that, you canf ile a claim against them for financial compensation. Below is a link to my article about surety bonds and how to file a claim using them. Red Rock Nissan’s bond company, according to the Auto Industry Division’s website, is Nationwide Mutual Insurance Company & their Bond Number is 7901071248

Nationwide Mutual’s Customer service # is (877) 669-6877

Contact Nationwide Mutual’s Customer Service department and ask them for the procedure to file a claim against RR Nissan’s surety bond. You’ll need that bond number to file the claim. Have all your documents scanned and ready to upload, or be ready to mail hard copies to the company with your claim. Also, be ready to state how much $$ you want in compensation for this debacle, and base it on something justifiable. The surety bond company will open an investigation and hopefully compensate you financially for the mess you’re in.

https://annelandmanblog.com/2024/07/defrauded-by-a-dealership-and-cant-afford-to-sue-theres-another-way-to-get-compensation-make-a-claim-against-the-dealerships-surety-bond/

Can I cancel the Portfolio and receive credit on my contract? I bought my new Hyundai Venue last Friday and repeatedly told them I didn’t want Portfolio. Finally I wa told that of o refused Portfolio my savings would NOT be the $2,500 but instead only $500-600 because other costs would be adjusted. Now I have Portfolio and still feel used.

Yes, you should be able to get a full refund on your Portfolio purchase within 60 days of buying the vehicle. Here’s a link to the Portfolio cancellation form. Just fill it out, get somebody at the dealership to sign it and get it to their cancellation dept yourself to make sure it gets there in a timely fashion. The address is on the form.https://ads-sitebuild.squarespace.com/s/Portfolio-Cancellation-Form.pdf

I contacted Bryan Knight at 801-792-3711 and he deleted the Portfolio from my purchase agreement. Within 15 minutes I received a call from Red Rocks acknowledging the deletion. I am so thankful and very pleased with this result. Kudos to Anne Landman for bringing this to our attention and to Bryan Knight.

That’s a great outcome, Barbara. So glad to hear they did right by you.

Reinsurance is used by insurance companies to spread risk to the reinsurer in case the original insurer is hit with an extraordinary number of large claims like a hurricane, pandemic, etc. By spreading the risk costs for the insured are reduced. This is a completely different use of reinsurance and seems to do nothing for the insured and is only to run up profits. A case for the Insurance Commission?

Vehicle extended warranties aren’t covered by the Colorado Insurance Commission. Huge loophole.