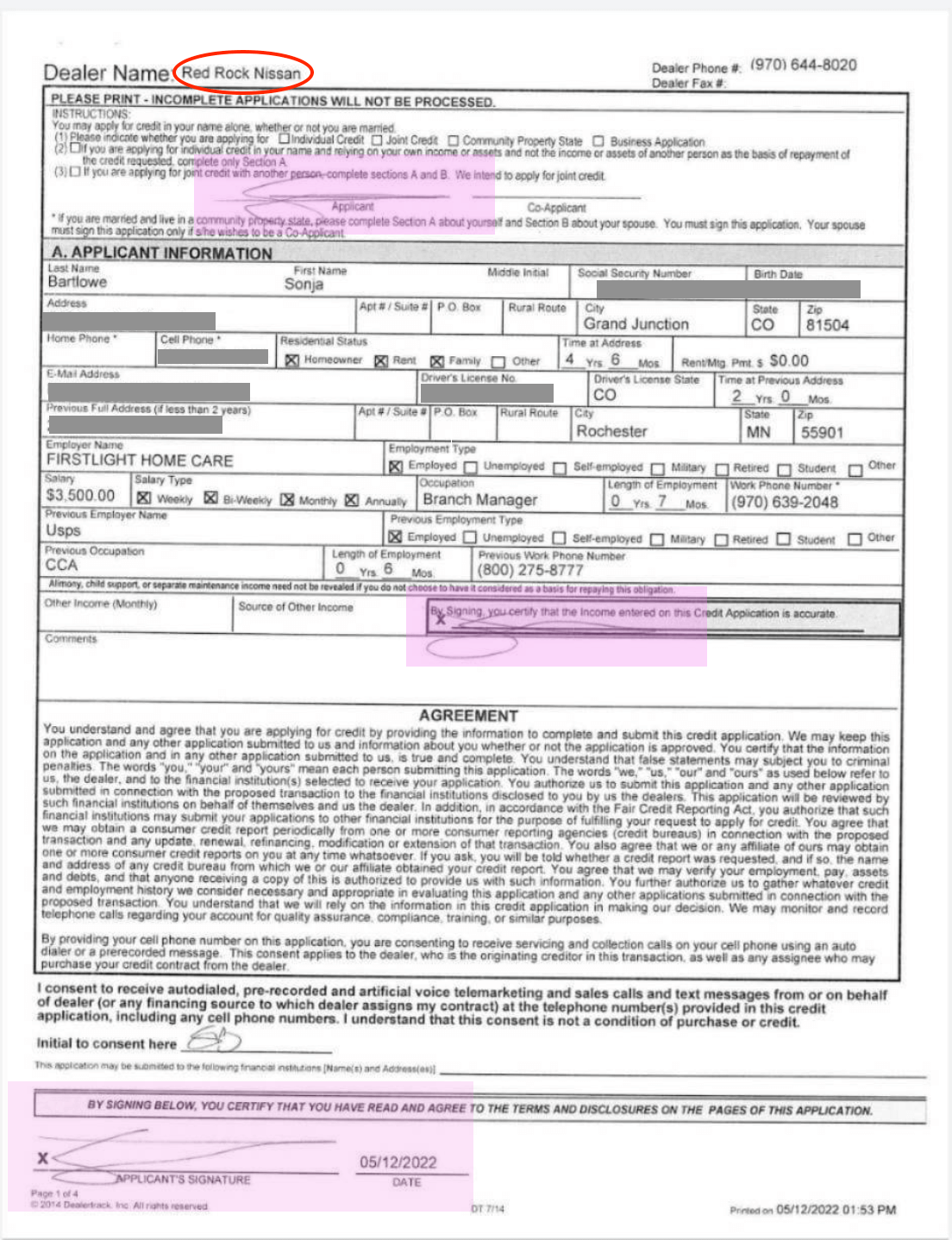

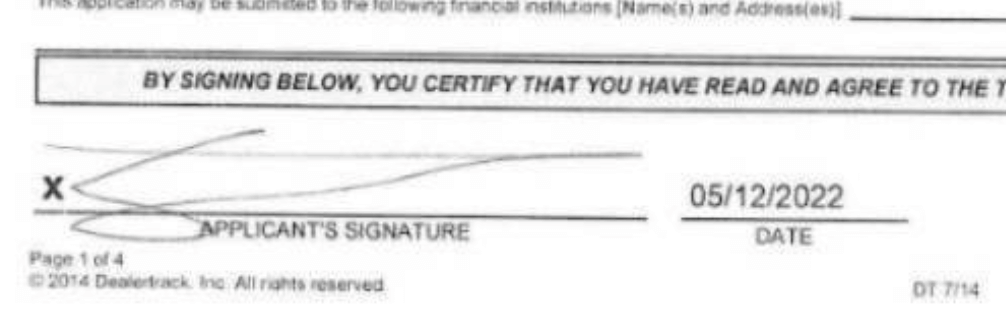

Credit application with Sonja Bartlowe’s real signature on it in three places. Her $3,500 gross salary type is marked “weekly,” “bi-weekly,” “monthly” AND “annually.” The application says at the top, “Incomplete applications will not be processed,” but none of the boxes below that are checked to indicate whether she is applying for an individual, joint or business loan.

Sonja Bartlowe is a single mom with two little girls and no child support who worked as a branch manager for a home care provider. Last May she traded in a vehicle and bought a 2016 Nissan Titan pickup truck priced at $39,000 from Red Rock Nissan, at least that’s what it was priced online.

Little did she know what she was in for.

A sample of Red Rock’s proprietary thumb drive that they use to hand people their documents. It’s about the thickness of a key.

During the closing of the sale, she gave the financial manager her digital signature on an IPad, except for one document she signed with a pen. Like others who patronized Red Rock, she was never shown her contract while at the dealership, even after it was signed, and was given her documents on a thumb drive.

Later, Sonja found out her payments on the truck were $763/month — a heavy lift for her financially, and far beyond the $500 she told the dealership she could afford. Making her payments has been a struggle. She’s had to rely more on credit cards to make ends meet, and that has tanked her credit score, making it even harder for her to provide for her family and get out of debt.

Sonja only saw her contract for the vehicle after it started having a slew of mechanical problems shortly after she bought it. She took it for an oil change that took 2 days. Within 5 days after that, her batteries went out and within 90 days of buying it the “check engine” light came on and she said the dealership wanted to keep it for 4 weeks “as a warranty procedure.” Finally, the turbo went out and she “had to print [the contract] off for my turbo warranty.”

It was then that she saw Red Rock had charged her $44,200 for the truck, far above the $39,000 it had been priced online. Sonja has witnesses to the $39,000 price, too, she says, who “saw it and are willing to go to court if they have to.” She also saw she had been charged $1,200 for “Resistall,” that she didn’t know about, and was charged $3,750 for an extended warranty that was supposed to cost her $3,000.

Then finally, after hearing about Red Rock’s forgery problem, she took closer look at the contracts only to find that the signatures on them were not hers.

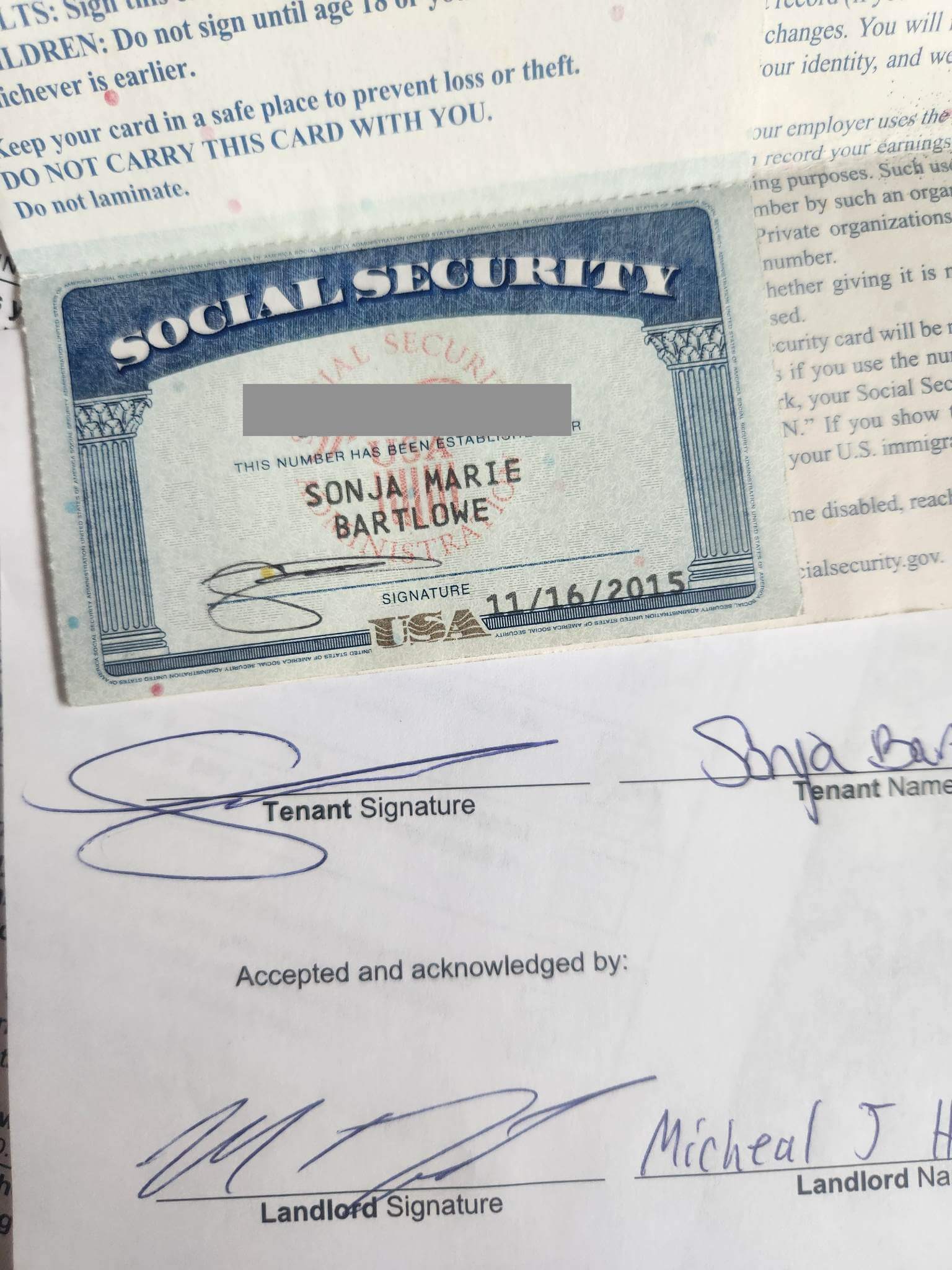

Sonja provided other examples of her real signature for comparison, and says she always signs her signature the same way:

Additional samples Sonja provided of her real signature

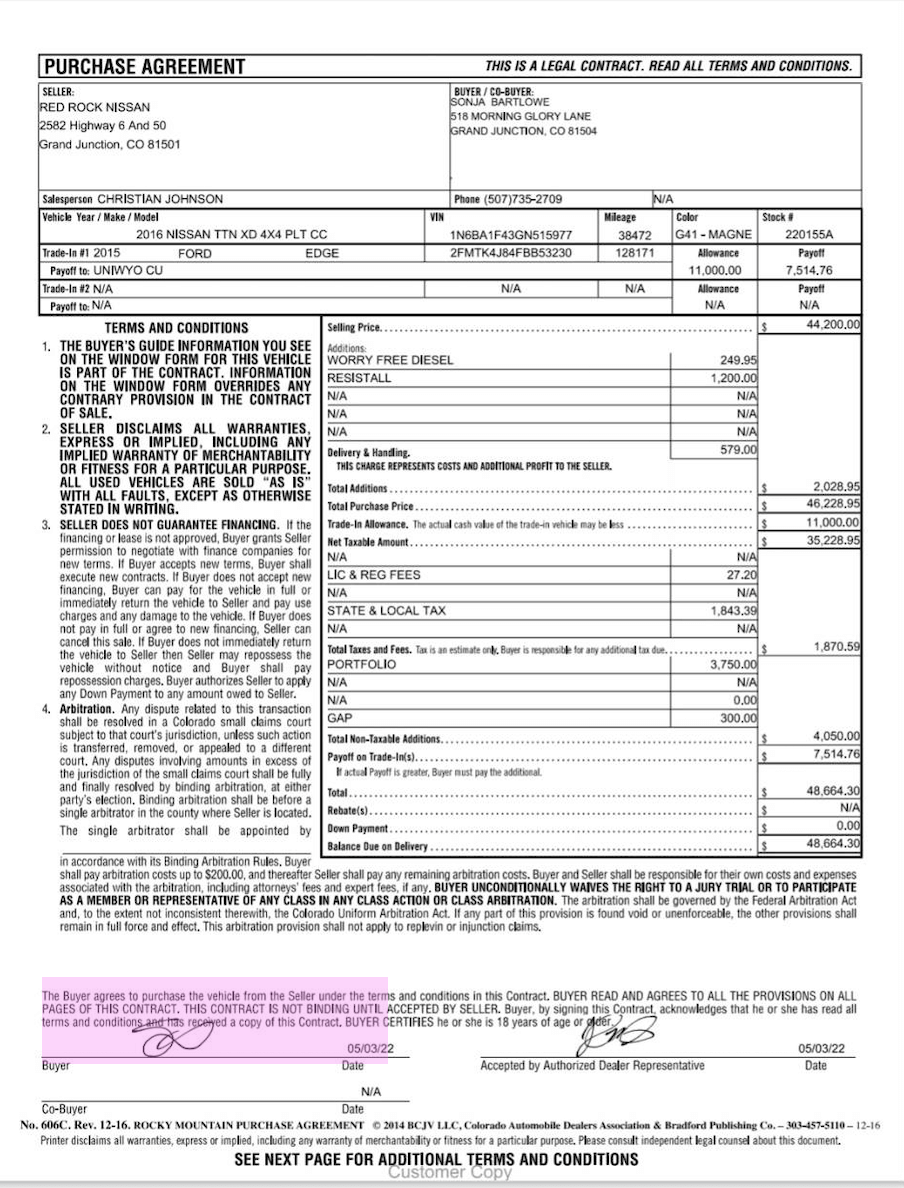

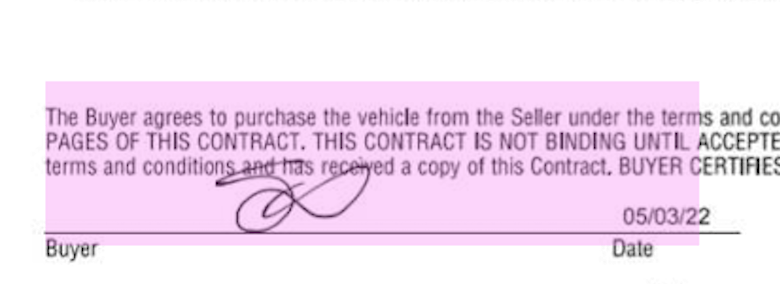

Below is the contract for the purchase of her vehicle. The “Buyer’s” signature appears far different than her real signature:

Sonja Bartlow’s contract for her vehicle, with a “Buyer” signature she says is not hers. She moved out of state and no longer lives at the address on this contract.

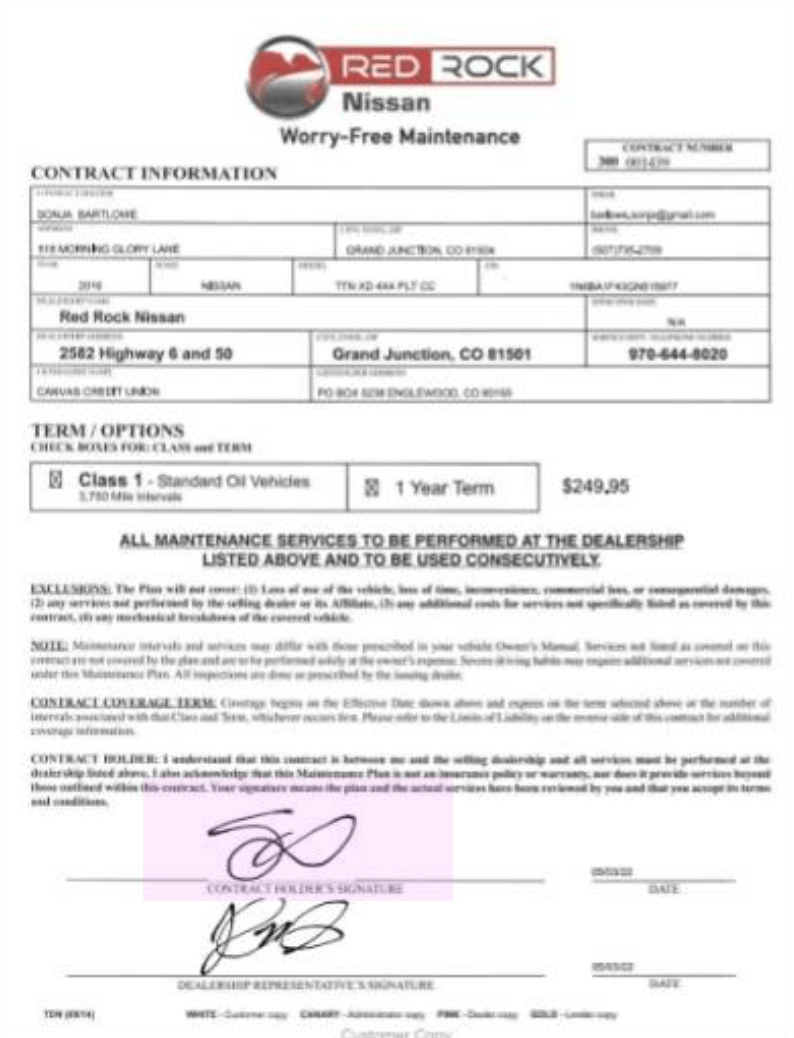

Here is the signature on her contract for “Worry-Free Maintenance”:

Sonja’s contract for “Worry-Free Maintenance” with a signature she says is not hers.

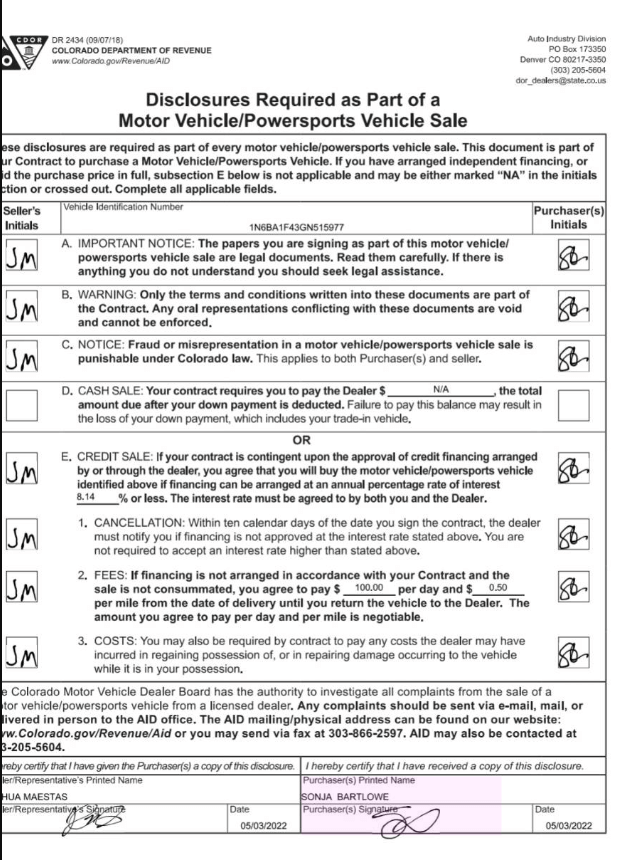

…and the “Purchaser” signature on her Disclosures form:

Another form with a signature Sonja says is not hers. Sales person was Joshua Maestas.

Below are close-ups of Sonja’s real signature and the one on her purchase contract:

Sonja Bartlowe’s true signature

The signature on Sonja’s contract to buy the vehicle

If you believe you have been a victim of forgery or had extra charges added to your vehicle purchase contract without being told or giving permission, fill out a complaint to the Colorado Department of Revenue’s Auto Industry Division at this link. Follow the instructions and have photos of your documents ready to upload as evidence.

If you believe you have been the victim of a financial crime, including falsification of your signature on a legal contract while transacting business within the City of Grand Junction, fill out a Grand Junction Police Department Fraud Packet, available at this link (pdf), and follow the instructions on the packet to report the crime to the GJPD.

Forgery of a signature, if done with intent to deceive, is a serious crime in Colorado.

Also, if any of this happened to you, contact your lender and tell them you want to see all of the information the dealership submitted to them about you for your loan on the vehicle. Carefully check what you get back to see if the salary information and description the dealership provided to the lender for the vehicle you bought is accurate. Flag anything that is not accurate, for examples incorrect salary and features the vehicle doesn’t actually have, or an incorrect trim level. Check your sale documents to see if the “Buyer” and “Purchaser” signatures match your real signature or not.

If you find something wrong, gather all your contracts, invoices, agreements, credit applications and any other paperwork, and in addition to reporting it to the above enforcement agencies, contact the dealership owners and tell them you need help. Have in mind what you’d want them to do for you to feel okay given the deceptions that you encountered in the course of making your purchase, and the financial trouble the deal may have gotten you into. Giving the dealerships a chance to fix the situation may be your best bet to quickly get out of a desperate financial situation that you got into by falling prey to these dealerships’ deceptive sales practices.

If you dealt with Red Rock Hyundai, GMC or Honda in Grand Junction, contact platform manager Bryan Knight at (801) 792-3711 or bryank@tdauto.com. If you did business with Red Rock Nissan or Kia, contact platform manager Brantley Reade at (801) 915-0929, brantleyr@tdauto.com

It looks like the initials are computer generated because they are identical. No one should expect a computer generated initial to match a handwritten initial sample.

Look at the signatures.

I did. Unless I’m missing something, every one looks the same except the one she initialed by hand

Personally, I would not encourage anyone who has had a negative experience with any of these underhanded dealerships to give them a chance to “fix” things. It may affect your ability to pursue a legal resolution of the matter and will slow down the authorities attempts to end these deceptive practices. I can see that such a course of action would make life easier sooner and that is tempting. I would love to hear from a legal expert on this blog regarding the correct course of action!

Many times, as in small claims lawsuits, one of the requirements is to have approached the person you are suing before the court will take the case.

This is about the forgery and the suits are likely to be greater than the small claims court handles.

Again, I would like to hear from an attorney on this subject.

In a larger case, the defendant will need to be notified of the charges. The plaintiff will need solid proof of his/her claims and usually a lawyer will need to be hired. In civil cases it will be up to a judge who has the best case. A pretty costly process so you better have a good case and it might be better to settle out of court.

In a criminal case, such as forgery. it would be up to the district attorney to decide if there is a case worth pursuing,

or that he/she could win.

I’m not a lawyer, but I do watch Law and Order. 🙂