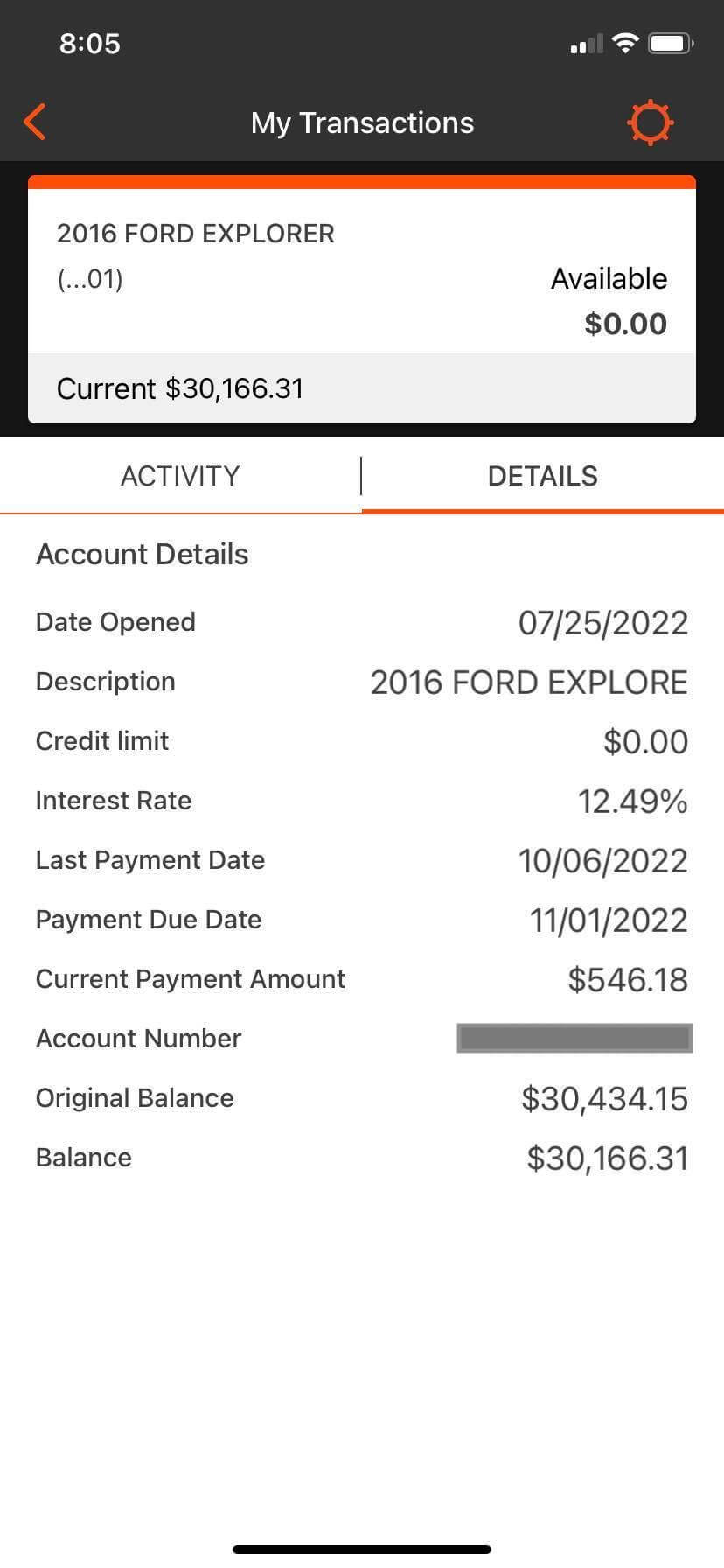

Lyn M. says this screen shot “is all we know about the loan” she and her husband got from Red Rock Nissan in Grand Junction. They went to Red Rock to buy a car advertised on the dealership’s website at $17,000. Without knowing it, they came out with a loan for $30,000 at an interest rate of 12.49%, far above what they could afford.

Lyn Anderson and her husband Jim (not their real names) thought they should trade in their older Ford pickup and get a slightly newer, more family-friendly vehicle, so they went online to see what was available locally.

Little did they know what they were getting themselves into.

On the Red Rock Nissan Grand Junction web site, they spotted a used 2016 Ford Explorer a few years newer than their pickup, that was listed for sale at $17,000. They thought they could just swing the purchase if they could keep their monthly payments at about the same amount they had been paying on their existing vehicle loan.

The couple had already had a previous run-in at Red Rock Nissan, so they thought they were well prepared for how the dealership operates, and could deal with it.

In that first encounter, Lyn said, they had agreed on a purchase price for another vehicle at an acceptable interest rate, but when they went into the dealership to sign for the deal, the documents showed a higher payment and interest rate than they had already agreed to. The couple refused to sign and walked out, escaping a rip off.

With this experience under their belts, Lyn and Jim thought they were ready to deal with any further shady behavior by the dealership when they went back to consider the Explorer.

At the dealership, they looked at the vehicle, told the salesperson the monthly payment they needed, signed a few papers regarding their trade-in and went home. Shortly after they got home, Red Rock sent them an email that instructed them to provide electronic signatures, which they did.

“The signature link expired before I could screen shot it,” Lyn said.

Blindsided by electronic signatures

After that, Lyn said, they found out “We signed a loan application without it having a loan amount” on it, and “they never even told us a purchase price” they had paid for the vehicle. The dealership also added a warranty to their contract without telling them, and the Andersons had no idea how much they had been charged for the warranty. Their signature had been applied electronically and “we have never seen the actual contract.” The Andersons got their documents on a USB drive.

Later, the Andersons were astonished to find out they were now on the hook for a $30,000 loan at a 12.49% interest rate — for a vehicle that had been priced at $17,000. Lyn said “They overcharged me $12,000 on a loan I didn’t know I signed!”

They found themselves stuck with payments $150/month higher than their previous loan — far higher than they could afford.

Lyn and Jim were upset that they had unknowingly gotten themselves so much deeper into debt, and blamed themselves because they didn’t see what they were signing. But what they didn’t know was that they were far from being the only Red Rock customers who were treated this way and found themselves in a bad situation.

Jim had to increase his work hours to help pay off the debt. He’s now working 60 hours a week with only Sundays off.

Tim Dahle, owner of the Tim Dahle Nissan dealerships of Utah, which also own the Red Rock dealerships in G.J.

Lyn was a stay-at-home mom until August, but after the Red Rock deal, she had to get two jobs to help the family stay afloat financially, a situation that is now taking a toll on their kids.

Lyn said,

“I’m working two retail jobs at 40-50 hours a week. We also have two special needs kids that are now having more issues because so much of the home dynamic has changed, so we are hoping we can get to a point within the next 12-18 months where I only have to work one job. We are trying to refinance [the car] now, [but] we were holding off because we were trying to buy a home, which now has to be put on hold.”

The family had the vehicle for just 55 days when the transmission went out. After that, Lyn was left without a car for 22 days.

The family is now trying to refinance their Red Rock loan at a lower interest rate to help them climb out of debt.

Lyn wanted her family to remain anonymous for this article because they still have to deal with Red Rock Nissan’s service department over the engine problems they’re still having with their Explorer.

She wants others to know what happened to them because “I just don’t want others to be taken advantage of, either. I want people to know the shady things they do” at Red Rock Nissan.

One of the papers from Red Rock Nissan the Andersons actually signed with a “wet signature.” The document indicates they were dealing with “Tim Dahle Nissan Auto Group” and says they have to comply with Utah state laws, not Colorado laws. The Tim Dahle Auto Group is a Utah-based corporation that owns the Red Rock dealerships in Grand Junction. Using electronic signatures in a way that deceives buyers appears to have originated with Tim Dahle-owned dealerships in Utah.

Red Rock Nissan had the Andersons sign a “You Owe” form without any of the figures filled in. The Andersons took these photos of the forms when they signed them.

Related stories: Customers fleeced out of thousands by Grand Junction Red Rock dealerships, Nov. 1, 2022

Another Red Rock dealership victim, Nov. 17, 2022

#FraudRock

Red rock Hyundai did the same thing to my grandmother in December of 21 she bought a2015 Ford f250 that was advertised as around 9500.00 but she is paying 35000.00 for it somehow and not red rock Hyundai or premier members credit union will even give her or I the loan paperwork to see why the price jumped so much and now they have not accepted payment for around a month now from her or I but tell her the truck is up for repossession unless she pays them 3000.00 plus repo fees so who does someone talk to about them I now have the truck in my possession tell they give my grandma answers and her paperwork

Eddie, your Grandmother has a right to see the credit application Red Rock submitted to her credit union for her loan in 12/21. She needs to go to her credit union in person, talk to the loan officer and ask them to send her all the info Red Rock sent them through CUDL (Credit Union Direct Lending) system, including the sales contract, credit app, and booking sheet on the truck she bought. Look the documents over for things like falsely inflated income, lies about the features on the vehicle, etc.,that would make your grandma eligible for a loan higher than what she can reasonably afford. If you think they took advantage of your grandma or used fraudulent tactics like forged signatures or obscured numbers to fool her into signing a bad deal, she can also file a complaint about Red Rock here https://sbg.colorado.gov/aid-complaint-form

They did the same thing to me with a 2008 F 150 that wasnt even supposed to be sold:they didnt even give me my loan contract and car fax until 14 months of fighting with them whe i finally recieved it they have forged my name saying i seen the car fax wich is a lie because i found out about the truck when i went to modern clasic motors to see if they could help me get into something more reliable and we went through kelly blue book to see what they would offer and kelly blue book wouldnt even touch it thats when i got to see the carfax the very first time i went straight iver to red rock to have them explain what the hell they were doing and eveytime i went i there they would do a hard pull on my credit the did it so much they dropped my credit score down to a 413from a 600, they have westlake financial in it as well cause i told then numerice times to come get the truck niether one would west lake just wrote it off and put it on my credit so i cant get a loan for a piece of gum let alone car the owner wont even talk to me man to man still to this day and it been 3 yrs

To me this is a crime. What does the written law say. Why can a business trick continue to trick and deceive honest customers?

Mesa County D.A. wrote me that “[I]t is illegal to use anyone’s signature, or to affix a signature to anything, without their authorization and with the intent to defraud anyone. The situation you describe sounds like it is both without their authorization and with the intent to defraud them.” He has enlisted the assistance of the state AG’s Fraud division on the Red Rock matter.

This is so good to know, and thank you for supplying the reality. They are on free t.v., advertising all of their car lots. If people only knew. Would you be willing to contact the local news stations with this story so people will be more than aware? At this time of year it would benefit people doing business with them.

Hi Susan, the local TV stations read my blog, but as you mentioned, those same stations also accept significant amounts of paid advertising from the Red Rock dealerships, which is certain to discourage their newsrooms from talking about how the chain is devastating local families and individuals through their shady sales techniques.

Anne, stations that accept ads from businesses that repeatedly cheat customers are risking their own credibility, and can lose ad revenues. It’s happened here in Rochester (NY) area.

Dear Tim Dahle, Karma time!

Hopefully they are suing for what appears to be fraud.